HSA vs FSA vs Insurance vs Private Pay: What's Best for Therapy?

Fightress Aaron

1/4/20265 min read

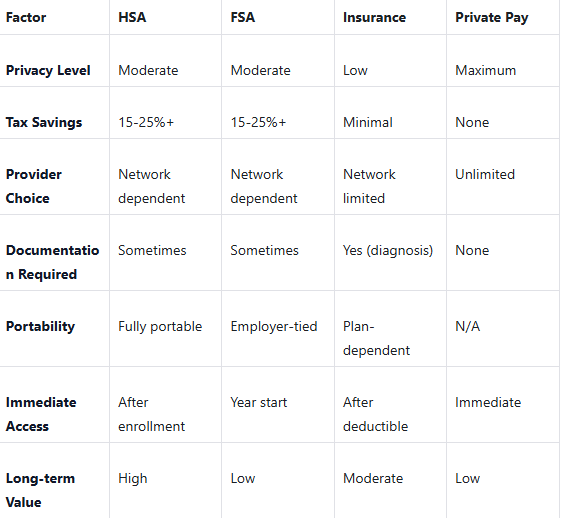

Choosing how to pay for therapy isn't just about money: it's about privacy, autonomy, and long-term implications you might not have considered. If you're weighing your options, you're facing a decision that could impact everything from your tax savings to your future career prospects.

The reality is that each payment method comes with trade-offs that extend far beyond your bank account. Understanding these differences can help you make an informed choice that aligns with both your financial situation and your need for privacy.

The Diagnosis Dilemma: Privacy vs. Coverage

Here's something many people don't realize: insurance companies require a mental health diagnosis to cover therapy sessions. This requirement creates a significant privacy trade-off that deserves serious consideration.

When you use insurance, your therapist must provide a diagnosis code to justify coverage. This diagnosis becomes part of your permanent medical record and can have far-reaching implications beyond your therapy sessions.

How Diagnoses Can Impact Your Future

Mental health diagnoses in your medical record can affect several areas of your life:

Employment Implications:

Some employers may access medical records during background checks for sensitive positions

Federal jobs requiring security clearances often involve detailed medical history reviews

Certain professional licenses may require disclosure of mental health treatment

Security Clearance Considerations:

Government security clearance applications ask about mental health treatment

While seeking therapy isn't automatically disqualifying, diagnoses may require additional documentation

The stigma around mental health in security-sensitive roles remains a real concern

Life Insurance Accessibility:

Life insurance applications typically ask about mental health diagnoses

Certain diagnoses may result in higher premiums or coverage denials

The impact varies by diagnosis severity and insurance company policies

Recommendations for Different Situations

If Privacy is Your Top Priority

Choose private pay. The complete confidentiality and absence of medical records may be worth the higher cost, especially if you work in sensitive fields or value absolute privacy.

If You Want Maximum Tax Benefits

An HSA combined with a high-deductible health plan offers the best long-term tax advantages. You can build a mental health fund over time while enjoying triple tax benefits.

If You Need Immediate Tax Relief

An FSA provides instant tax savings without requiring a high-deductible plan. Just ensure you can accurately estimate your annual therapy expenses.

If You Want Balanced Coverage

Combine insurance with an HSA or FSA. Use insurance for basic coverage and tax-advantaged accounts to pay copays and deductibles more affordably.

If You're Changing Jobs Soon

Consider private pay or ensure your therapy timeline aligns with your new employer's benefits. FSAs aren't portable, and insurance changes can disrupt care.

The Hidden Costs of Each Option

Beyond the obvious financial differences, consider these less apparent costs:

Insurance Hidden Costs:

Time spent seeking pre-authorizations

Limited session numbers requiring justification for continued care

Potential for increased premiums if you have an extensive claims history

Network changes that may force provider switches

Private Pay Hidden Benefits:

Often, therapists offer sliding scale fees for private pay clients

No session limits or treatment restrictions

Direct relationship building with your provider

Ability to negotiate payment plans

Tax-Advantaged Account Considerations:

Administrative fees for account maintenance

Time spent tracking eligible expenses

Potential penalties for misuse of funds

Moving Forward with Confidence

Your mental health is an investment in your overall well-being, and choosing the right payment method is part of that investment. Whether you prioritize privacy, tax savings, or comprehensive coverage, there's an option that can work for your situation.

Remember that your choice isn't permanent. Life changes, job transitions, and evolving needs may lead you to switch payment methods. The most important step is starting your therapeutic journey: the payment method, while important, shouldn't delay your path to better mental health.

Take time to evaluate your specific circumstances: your tax bracket, employment situation, privacy concerns, and financial goals. Consider speaking with your HR department about available benefits and consulting with a financial advisor about tax implications.

Your mental health deserves the same thoughtful planning you'd give to any other important life decision. By understanding these payment options thoroughly, you're setting yourself up for both financial and therapeutic success.

To receive support and discuss which payment option works best for your situation, visit us at www.nbcounselingllc.com or call or text us at 334-293-1411. We're here to help you navigate both your therapeutic journey and the practical considerations that support it.

Timing Matters: Understanding Deductible Resets

If you're considering insurance coverage, understanding when deductibles reset is crucial for financial planning. Most insurance plans operate on a calendar year basis, meaning deductibles reset on January 1st.

Why Deductible Timing Impacts Your Decisions

Starting Therapy in December:

If you begin therapy in December, you'll likely pay full out-of-pocket costs until you meet your deductible. Then, just as your coverage kicks in, the deductible resets in January, and you're back to paying full costs again.

Strategic Planning:

Consider starting therapy in January to maximize your coverage period

If you need immediate help in December, factor in paying two deductibles within a few weeks

Use HSA or FSA funds to offset these costs, regardless of timing

Year-End Considerations:

HSA contributions can be made until April 15th of the following year

FSA funds typically must be used by December 31st (unless your plan includes grace periods)

Some insurance plans offer carryover provisions for unmet deductibles

Making the Right Choice: A Practical Comparison

Insurance Coverage: The Traditional Safety Net

Insurance coverage can significantly reduce therapy costs, but it comes with requirements and restrictions that may impact your privacy and provider choices.

The Benefits:

Shares cost burden through copays and coinsurance

Protection against catastrophic mental health expenses

Established networks of providers

Can be combined with HSA or FSA for additional savings

The Drawbacks:

Monthly premiums regardless of usage

Deductibles must be met before coverage begins

Network restrictions limit provider choices

May require prior authorization

Private Pay: Maximum Autonomy and Privacy

Paying out-of-pocket gives you complete control over your therapy experience but requires you to bear the full financial responsibility.

The Benefits:

Complete freedom in choosing any therapist

No insurance restrictions or authorization requirements

Maximum privacy: no insurance records

Direct relationship with your provider

The Drawbacks:

No tax advantages

Full session costs (typically $100-$300+ per session)

No protection against high expenses

No employer contribution support

Private Pay: Your Privacy Shield

When you pay privately, no diagnosis is required, and no insurance records are created. Your therapy sessions remain completely confidential between you and your therapist. This privacy can be invaluable if you work in sensitive fields or simply prefer to keep your mental health journey entirely personal.

Understanding Your Four Main Options

When it comes to paying for therapy, you have four primary pathways, each with distinct advantages and potential drawbacks that deserve careful consideration.

HSA (Health Savings Account): The Long-Term Saver's Choice

Health Savings Accounts offer the most comprehensive tax benefits available for healthcare expenses. You'll need to be enrolled in a high-deductible health plan to qualify, but the advantages can be substantial.

The Benefits:

Triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free

Portable across employers and life changes

Funds roll over indefinitely: no "use it or lose it" pressure

Potential tax savings of 15-25% or more, depending on your bracket

The Drawbacks:

Requires high-deductible health plan enrollment

May need documentation for some mental health services

Higher out-of-pocket costs initially until the deductible is met

FSA (Flexible Spending Account): The Predictable Spender's Tool

FSAs work best when you can accurately predict your therapy expenses for the coming year. They offer immediate tax relief without requiring a high-deductible health plan.

The Benefits:

Pre-tax contributions reduce your taxable income

Immediate access to full annual contribution at plan start

Same potential tax savings as HSAs (15-25%+)

Some employers contribute matching funds

The Drawbacks:

"Use it or lose it" structure: unused funds typically forfeit

Tied to your employer

Requires accurate annual expense estimation

Not portable between jobs